Realized is an end-to-end platform that helps you exchange 1031-eligible properties for diversified portfolios of tax-efficient property interests, customized to your shifting income goals, risk appetite, and investment objectives across generations.

Collectively, the team at Realized has a wide range of applicable experiences, but all share the same mission, to improve lives through innovative real estate wealth solutions. The timeline below is just a glimpse of the journey we’ve been on and a peek into the future.

We started with a premise based on “simple.” Make 1031 real estate exchanges less time-consuming, complex, and difficult for the 1031 investor - and by doing so, make them more profitable as well. Our mission was simple: to improve lives through innovative real estate wealth solutions.

Quickly, though, our mission inspired more. Something bigger than just 1031 exchanges. Post-exchange, a problem still existed among our investors. They needed a solution that bridged the gap between their investment properties and sophisticated wealth management techniques. Soon, we devised a solution: Investment Property Wealth Management®.

The purpose of Investment Property Wealth Management® is to help investors meet their income needs in retirement, manage their risk, and preserve their property wealth across generations — all while managing investment property wealth like they do other investments.

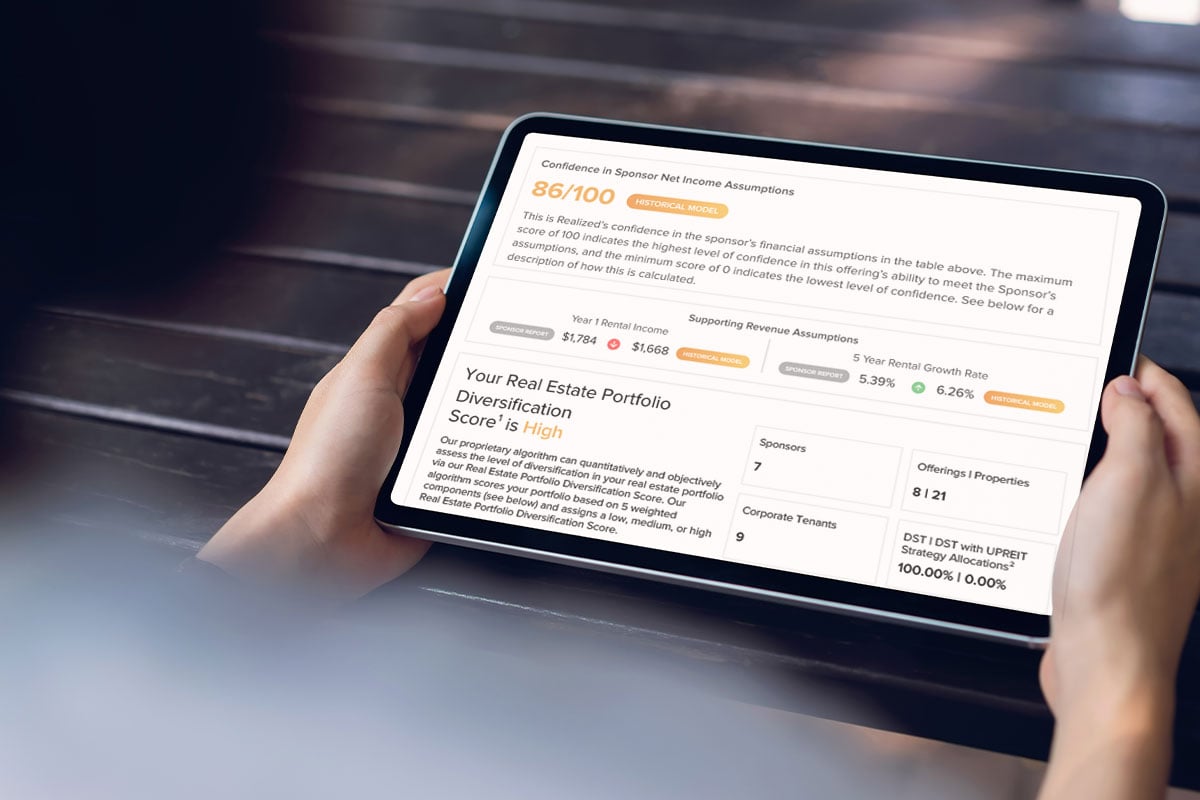

By combining deep real estate investment expertise and technology, the Realized platform develops investment strategies designed to maximize after-tax, risk-adjusted returns. We develop a holistic plan that helps investors manage their wealth tax efficiently — giving them the tools to help them through this major financial decision.

We simplify the process by making it possible for investors to defer their taxes and find a replacement property that meets their needs, risk preferences, and goals. We create long-term relationships based on stewardship, transparency, and growth. All with one vision in mind: to be the team and technology that investors trust to build tax-efficient real estate wealth.

SECURITIES DISCLOSURE

Realized1031.com is a website operated by Realized Technologies, LLC, a wholly owned subsidiary of Realized Holdings, Inc. (“Realized Holdings”). Securities and/or Investment Advisory Services may be offered through Registered Representatives or Investment Advisor Representatives of Realized Financial, Inc. ("Realized"), a broker/dealer, member FINRA/SIPC, and registered investment adviser. Realized is a subsidiary of Realized Holdings, Inc. ("Realized Holdings"). Check the background of this firm on FINRA's BrokerCheck.

Hypothetical example(s) are for illustrative purposes only and are not intended to represent the past or future performance of any specific investment.

Investing in alternative assets involves higher risks than traditional investments and is suitable only for sophisticated investors. Alternative investments are often sold by prospectus that discloses all risks, fees, and expenses. They are not tax efficient and an investor should consult with his/her tax advisor prior to investing. Alternative investments have higher fees than traditional investments and they may also be highly leveraged and engage in speculative investment techniques, which can magnify the potential for investment loss or gain and should not be deemed a complete investment program. The value of the investment may fall as well as rise and investors may get back less than they invested.

This site is published for residents of the United States who are accredited investors only. Registered Representatives and Investment Advisor Representatives may only conduct business with residents of the states and jurisdictions in which they are properly registered. Therefore, a response to a request for information may be delayed until appropriate registration is obtained or exemption from registration is determined. Not all of services referenced on this site are available in every state and through every representative listed. For additional information, please contact the Realized Compliance department at 512-472-7171 or info@realized1031.com.

© 2026 Realized Holdings, Inc.

Contact us to see whether this type of investment can meet your objectives.

By providing your email and phone number, you are opting to receive communications from Realized. If you receive a text message and choose to stop receiving further messages, reply STOP to immediately unsubscribe. Msg & Data rates may apply. To manage receiving emails from Realized visit the Manage Preferences link in any email received.