Our Proprietary Methodology

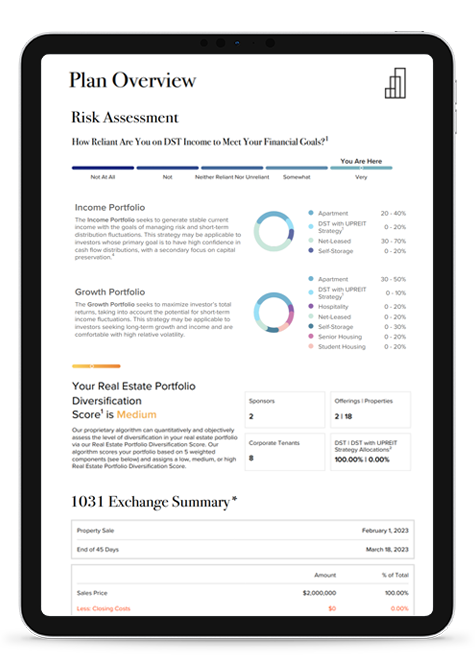

Goals-Based Portfolios

Our goals-based portfolios are the starting point we use to build your tailored investment plan. Each of these goals-based portfolios is built with one of three main objectives in mind: capital preservation, income generation, or growth.

Confidence Score

The Confidence Score represents the level of confidence Realized believes your overall portfolio has to reach Sponsor income projections.

Diversification Score

The Diversification Score is a proprietary measurement that assesses the overall level of diversification in your portfolio according to five different components.