Portfolio Development

Enhanced Up-Front and On-Going Due Diligence

Realized conducts comprehensive, unbiased reviews of potential investments, including sponsor history, real estate quality, deal structures, and securities compliance. The Platform provides detailed reports, allowing advisors and investors to easily compare deals and sponsors without conflicts of interest. Realized helps satisfy regulatory requirements for ongoing due diligence. The Platform utilizes cutting-edge technology for risk analysis and thorough due diligence for the life of an investment. It simplifies reporting, streamlines compliance, cuts review times, minimizes disruptions, removes the need for additional staffing.

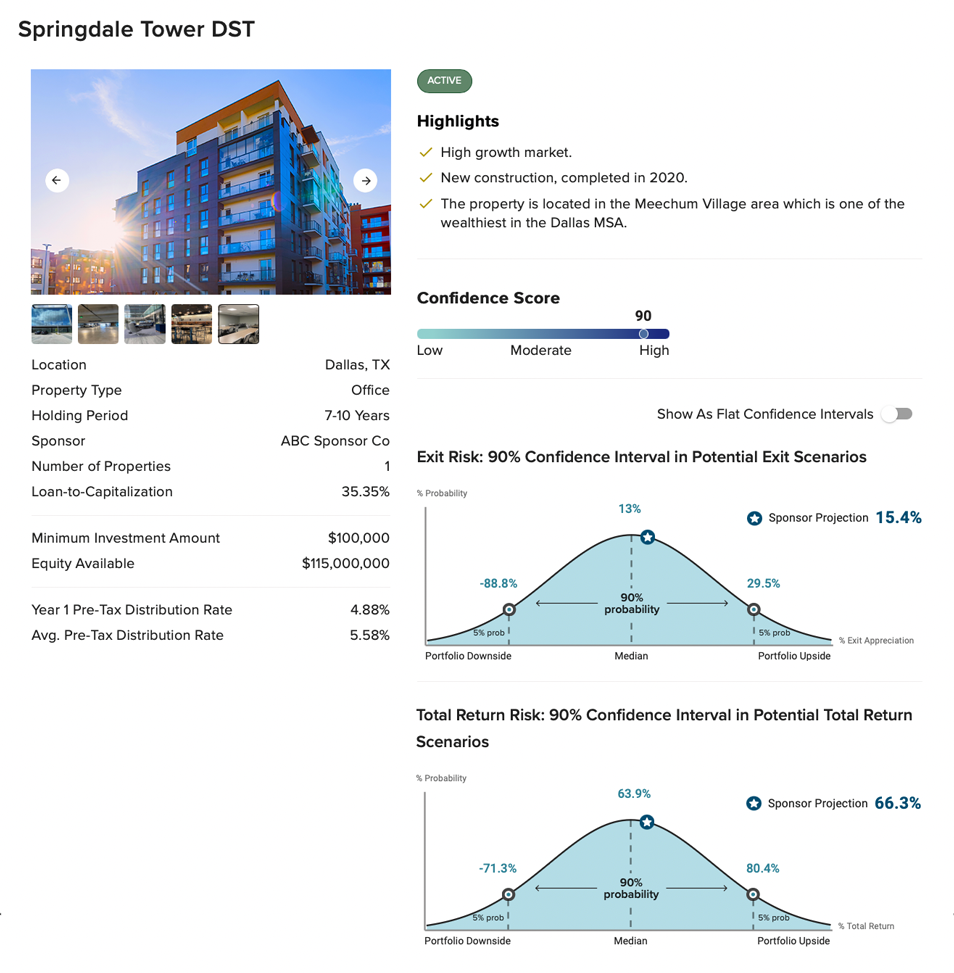

Realized Confidence Score®

Objective, statistical risk quantification has been missing for real estate and DSTs until now. The Platform's risk algorithm, utilizing the Realized Confidence Score®, helps to provide a straightforward, objective evaluation of deals based on their potential risk-adjusted returns. It gives advisors peace of mind when recommending DST solutions to their clients.

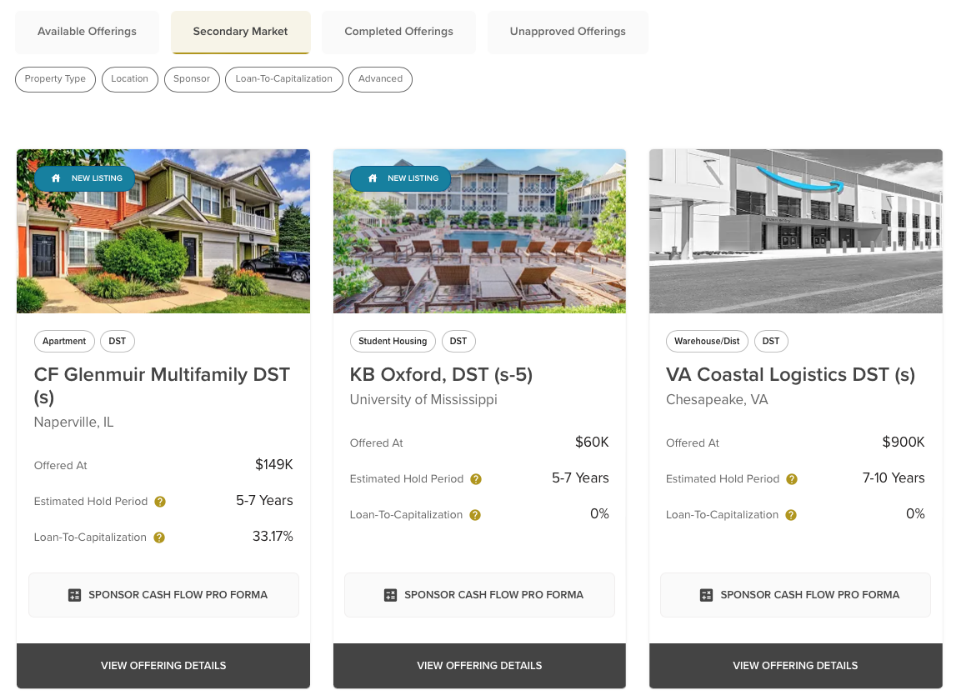

Liquidity Management

Our FINRA- and SEC-reviewed Alternative Trading System secondary market offers potential liquidity for DST investments, providing investors, advisors, and sponsors with flexible exit strategies to handle portfolio adjustments and life events —one of the most common challenges with DSTs.

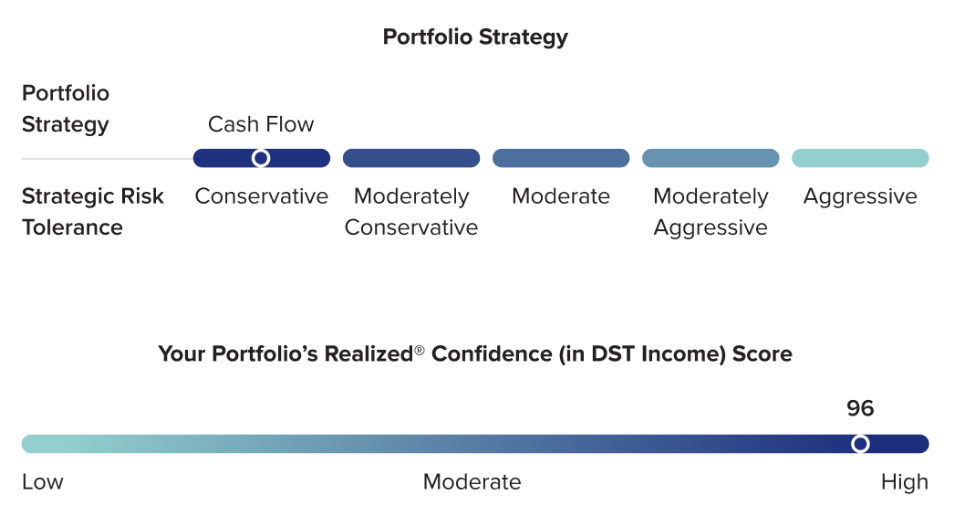

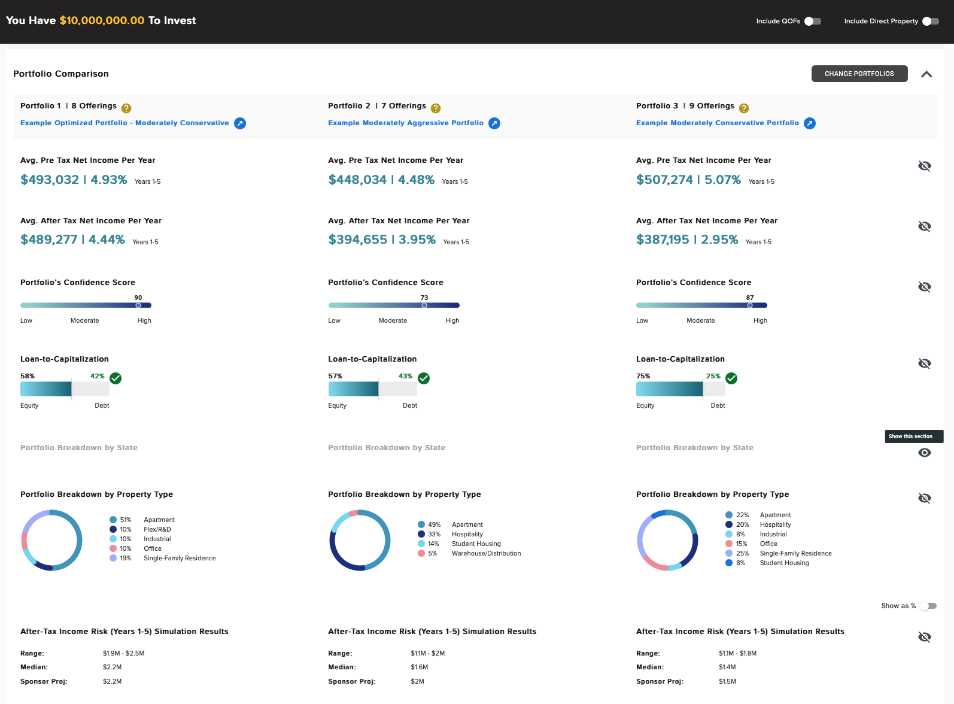

Portfolio Construction

The Realized Platform helps integrate real estate into traditional wealth management. Advisors can utilize goals-based portfolios aligned with common investor objectives, or create customized portfolios for unique needs. Our proprietary models account for 1031 exchange requirements, investment goals, and risk tolerance, optimizing outcomes after taxes while considering each investment’s financial structure. The Realized Diversification Score™️ measures the diversification of a portfolio by analyzing factors such as rent correlations and historical market trends.