Ways to Invest–Opportunity Zone Funds

Opportunity Zone Funds, or Qualified Opportunity Funds (QOFs), are partnerships or corporations with the sole purpose of investing in Opportunity Zones. Rather than putting your money directly onto QOZs, you invest in the funds, which then funnel your capital gains into QOZ projects.

QOFs typically fall into one of two categories:

Identified funds have specific QOZ projects already in the works, or under contract. The advantage to this fund structure is that you know upfront what project or projects are being financed and developed. These funds are more transparent, and you can actually visit the development sites.

Semi-blind funds focus on raising capital first, then finding likely projects on which to spend that money. While these funds aren’t as transparent as their identified counterparts (and can be riskier), they have a higher level of liquidity. This can help lead to a quick acquisition and closing.

As is the case with other finances or funds, it’s essential to perform due diligence on QOFs prior to investing. Some of the details to examine include the following:

Track record. Because the Opportunity Zone program is still relatively new, complete information about a QOF’s performance might not be immediately available. In this situation, you can examine the Sponsor’s previous projects, risk mitigation efforts, returns, and other pertinent information.

Targeted property/properties. Whether the fund is investing in business property, stock, or a partnership interest, it’s important to understand where your money will be going and how it will be used. For instance, if the QOF is focused on real estate development, be sure to understand the viability of the asset type and where it is in the real estate cycle. If the focus is on stock or a QOZ company, ask to see a business plan and cash flow estimates. However, if you are investing in semi-blind funds, this information may not be available to you.

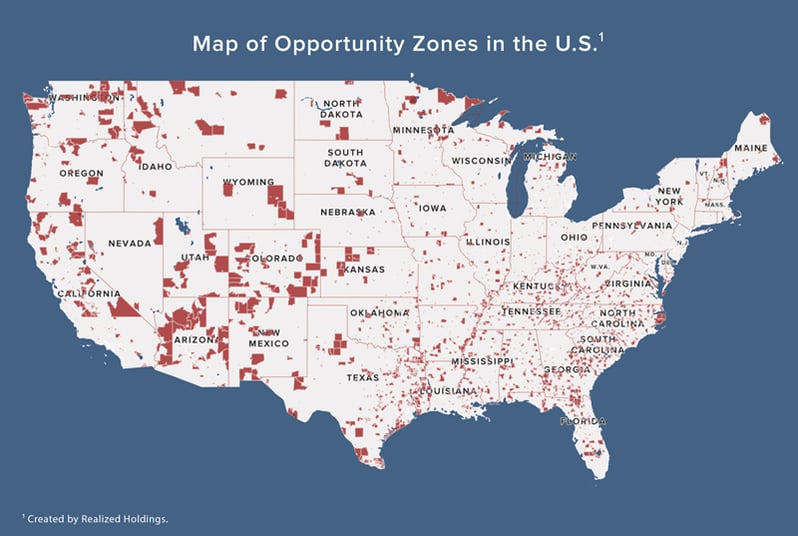

Geography. While there are more than 8,700 designated Opportunity Zones, not all of them may be a fit depending on each individual’s investment preferences and risk tolerances. Be sure to examine demographics, market data, location (both part of the country and where, within the actual QOZ), and competition.

Personnel. It’s also a good idea to know with whom you are investing. Reach out to the QOZ Sponsors and managers, and take some time to learn about the team (including how long it has worked together). This is also the time to get answers you might have concerning income distribution or tax preparation requirements.

You want to come away from the due diligence process knowing that the investment makes sense for you and your goals. Just because an investment is labeled “Opportunity Zone” doesn’t make it a viable or workable investment opportunity for you.