Qualified Opportunity Zones vs. 1031 Exchanges

The recent Tax Cuts and Jobs Act enacted in December 2017 created yet another vehicle to defer capital gains for real estate investors, this time in the form of opportunity zones. This vehicle, the Qualified Opportunity Zone Fund (QOZF), is similar to 1031 exchanges, which are transactions that also allow investors to defer capital gains on real estate holdings at the time of disposal. However, QOZFs present to accredited investors the opportunity to defer gains realized from investments in stocks, bonds, businesses, and other alternative investment types in addition to gains realized from real estate investments.

What States Don't Conform With QOZ Tax Benefits?

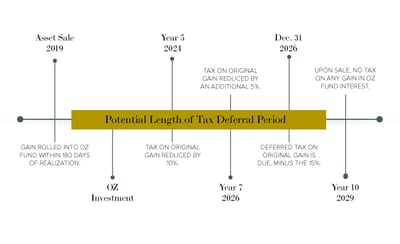

One of the highlights of the 2017 Federal Tax Cuts and Jobs Act (TCJA) is the Qualified Opportunity Zone (QOZ) program that gives taxpayers the ability to defer and potentially eliminate certain capital gains. Effective starting in 2018, the program is available for a limited window of time, and only provides incentives throughout a ten-year tax deferral period. To continue learning about the program, take a look at the timeline below, or read more here.

Tax Benefits Of Opportunity Zones

In December 2017, the Tax Cuts and Jobs Act was passed, offering a brand-new tax incentive for investors called Qualified Opportunity Zones (QOZs). Through the Qualified Opportunity Zones program, the federal government certified distressed, low-income communities throughout the United States as Qualified Opportunity Zones, providing much-needed resources to communities in need while offering tax advantages to those who invest in these neighborhoods.

Brokers, Bankers & Lawyers

This is part 2 of Ed Maddox's series, entitled: Things I Wish I Knew (While Completing My 1031 Exchange). For part 1, click here. When considering the sale of property and a 1031 exchange, we generally seek advice from trusted advisors during the initial stages. However, as I was going through my own 1031 exchange, I realized that sometimes those trusted advisors may not be the most well-informed on a particular subject. I resolved, therefore, to further my own knowledge in order to make the best decisions.

Realized Raises $6 Million Series A Round Led By Calibrate Ventures

Yesterday, we announced the raise of $6 million in Series A funding. The funding was led by Calibrate Ventures and joined by Rice Park Capital. We will be utilizing these funds to expand our team and technology.

The 90% Test Explained

The 90% Test is a method to validate if a QOF (Qualified Opportunity Fund) qualifies for the benefits of a QOZ (Qualified Opportunity Zone). The QOF must hold 90% of its assets in a QOZP (Qualified Opportunity Zone Property). A QOZP can be any of the following property types: QOZ business property (QOZBP). QOZ stock. QOZ partnership interests.

What Is A Quitclaim Deed?

If you have ever purchased or sold real estate, you may have received or been granted a deed in the process. If it was a traditional transaction between unrelated parties, you probably came across what is called a general warranty deed, which provided you assurance as a buyer that the seller owned the property outright, or vice versa. However, it is possible that you have never handled or been issued a quitclaim deed. Although similar in purpose to a general warranty deed, quitclaim deeds have unique features that differentiate them.

Dealing With The Emotional Attachment To Your Property

This is part 1 of Ed Maddox's series, entitled: Things I Wish I Knew (While Completing My 1031 Exchange). In many cases and for various reasons, the idea of utilizing a 1031 exchange often comes into existence when considering the sale of a property that has been held for a long time. Often times, the success of the property is due to sacrifice, sweat equity, and constant diligence of management on the part of the owners.

Qualified Intermediary Fees

You have just closed on your property and are looking to execute a 1031 exchange. Per IRS regulations, you need to establish a Qualified Intermediary (QI) and record another expense to complete the transaction. Although many other fees related to the transaction are standard and well-defined, it can be frustrating to gauge the cost for the services of a Qualified Intermediary. In order to understand what amounts to an appropriate fee owed to a QI, it is important to consider the services the QI provides and the risks it encounters in helping to execute a 1031 exchange.

Who Can Be Your Qualified Intermediary?

Consider this scenario for a moment: you recently sold a property and are preparing to enter into a 1031 exchange. You have everything in place, but soon learn that it is required to establish a Qualified Intermediary (QI) to complete the exchange – per IRS regulations. Who do you turn to?