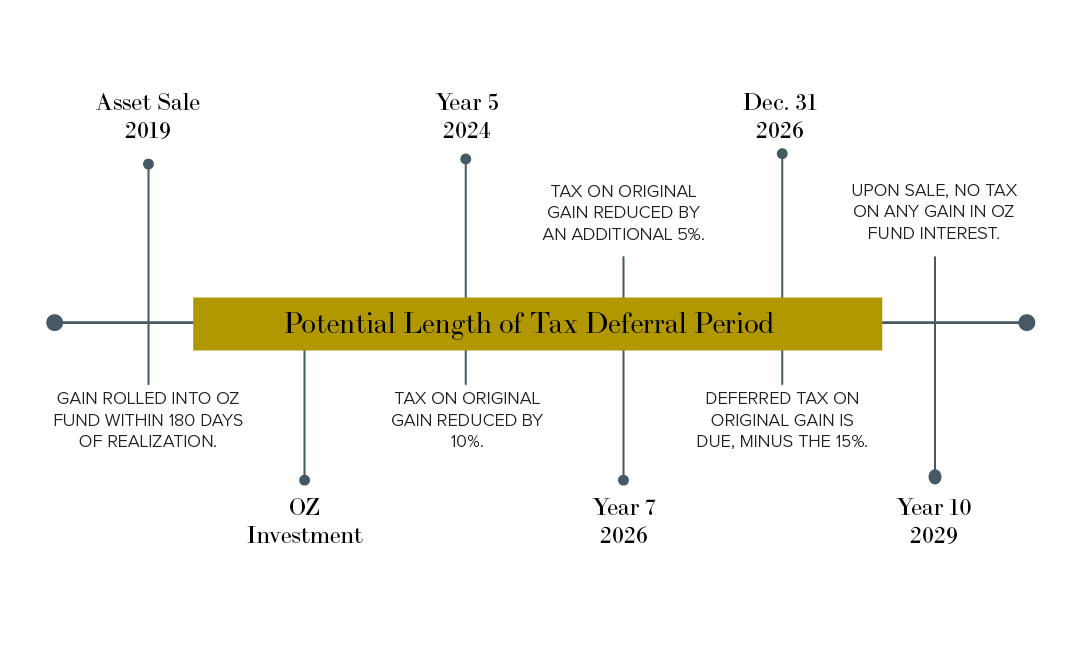

One of the highlights of the 2017 Federal Tax Cuts and Jobs Act (TCJA) is the Qualified Opportunity Zone (QOZ) program that gives taxpayers the ability to defer and potentially eliminate certain capital gains. Effective starting in 2018, the program is available for a limited window of time, and only provides incentives throughout a ten-year tax deferral period. To continue learning about the program, take a look at the timeline below, or read more here.

Just like with any amendment to the Internal Revenue Code (IRC), it is important to understand whether states will conform to that change. Most states have implemented the changes made by the TCJA, and since those states tend to start their computation of the income tax base with either federal taxable income (for corporations) or federal adjusted gross income (for individuals), the federal QOZ tax benefits will be incorporated for state income tax purposes as well.

Investors should note that this is not true for all states, and below we have identified some examples of states that do not fully conform to the federal QOZ tax benefits. Unless otherwise noted, these rules apply to both corporations and individuals.

Non-Conforming States

- California - The state does not currently conform, however in the 2019-2020 proposed budget, the governor proposed conforming only for investments in green technology or affordable housing.

- Currently, California treats capital gains as ordinary income, making any large gains subject to the state’s highest income tax rate: 13.3%

- Mississippi - Does not conform.

- North Carolina - explicitly decoupled from the QOZ provision and requires that the deferred gain be included in the state’s taxable income calculation, as well as any additions related to any step-up basis.

- Specifically, the legislation requires that taxpayers add back to federal income any capital gains that were deferred as well as any subsequent capital gains that were eliminated under those federal provisions.

Partially-Conforming States

- Arkansas - In February 2019, the governor of Arkansas signed SB196, which specifically adopted IRC § 1400Z-2 for tax years beginning on or after Jan. 1, 2018, but defined the term “opportunity zone” to mean “a population census tract located in Arkansas that is designated as a qualified opportunity zone under [section 1400Z] as of Jan. 1, 2019.”

- QOZ tax benefits only apply to investments in Arkansas.

- Hawaii - Originally, Hawaii decoupled from the amendment; however, on June 13, 2019, Hawaii approved legislation, S.B. 1130, to conform its tax code to the Internal Revenue Code, although the tax benefits are limited to QOZ investments held in Hawaii.

- Massachusetts - In June 2019, Massachusetts issued a Technical Information Release explaining that the state conforms to the federal QOZ tax provisions only for corporate income taxes but not for individual income taxes.

- Pennsylvania - conforms at the personal income level, not at the corporate income level.

To further complicate matters, one QOZ investment opportunity may be a portfolio with multiple locations across several states. This could result in an allocation by the state of the capital gains and/or differing recognition periods. Taxpayers that reside in a non-conforming state and/or invest in a QOZ fund that holds assets in QOZs located in a non-conforming state should analyze the impact on their state income taxes as they may not receive any tax benefits at the state level. Investors in these states may also be required to recognize gain for state tax purposes on their eventual sale of the opportunity fund investment.

A state’s conformity with the federal opportunity zones provisions is an important factor investors should consider.

- Taxpayers seeking QOZ investment opportunities should consider available local, state, and other federal incentives.

- Based on the investment, a review of each specific state’s regulations, complementary programs, and tax effects should be considered before setting up an investment vehicle.

It’s important to note that QOZ investments are at the higher end of the risk spectrum. Investors considering the opportunity should consult with their tax professional to better understand how the capital gains deferral and/or elimination applies to them directly. If you have questions and want to learn more about QOZ investments, please call a Realized financial professional at 877-797-1031.