The Evolution of the Retail Asset Class

The retail industry is all around us. Whether it is helping us put food on the table, clothes on our backs, or delivering us a common product, we rely on retail to provide us with what we need, when we need it. From local shopping centers to regional malls, retail properties are characterized by having the sole purpose of selling and delivering consumer goods and services. Although in a growing technological world where e-commerce has established itself as a threat to the retail industry, online retailers have still been establishing themselves in physical stores, only increasing the presence of the retail sector in commercial real estate. Offering both unique investment structures and the potential for higher than average risk-adjusted returns, retail has established itself as an attractive opportunity for real estate investors.

Student Housing: From Ramshackle Digs To Viable Investment

What is the first thing that comes to mind with the words “off-campus student housing?”

All Is Not Lost With Suspended Losses

Introduction A nice benefit of real estate investment is all the potential tax benefits. A well-thought-out real estate strategy can generate tax-sheltered or even tax-free cash flow for years. However, as any seasoned real estate investor will tell you, there are times when real estate investments generate losses whether from the aggressive use of allowed depreciation (good) or some vacancy or rental loss (bad). Common sense might dictate that those losses could be deducted in the year they occur, but because real estate income losses are always subject to the Passive Activity Loss (“PAL”) rules of the IRS, this is not always the case.

Keeping It Real, And Personal – Property, That Is

We discuss property in great deal in our blog posts. We talk about property that can be exchanged for other property, that can be held for investment, or that can be bought or sold.

Your IRA Can Fund Real Estate

Mention “individual retirement account,” and what might come to mind is “tax-deferred contributions.” You add cash, or cash equivalents, to your individual retirement account (IRA), to build value over time. An account administrator uses those tax-deferred contributions to buy stocks, bonds, funds, or other securities. When you retire, you have access both to the original contributions, and investment returns.

‘Tis the Season - For Installment Sales

The upcoming holiday season can be a time of joy, with family, friends and celebration. The holiday season can also be a time of stress, with tangled lights to untangle and hang, gifts to shop for and wrap, and parties to plan.

In a 1031 Exchange? You May Need to File a Tax Extension

Are you currently in a 1031 exchange or contemplating beginning an exchange before the end of the year? If you sold or are planning to sell investment property between October 17, 2017 and December 31, 2017, you should plan on filing IRS Form 4868 - Application for Automatic Extension of Time to File U.S. Individual Income Tax Return on or before April 15, 2018.

Tax Reform / 1031 Exchange Update - November 7, 2017

Last week, House Republicans released H.R. 1, their long-awaited 429-page tax reform proposal. The bill, which is titled the ‘Tax Cuts and Jobs Act (“TCJA”) leaves 1031 “like-kind” exchanges intact!

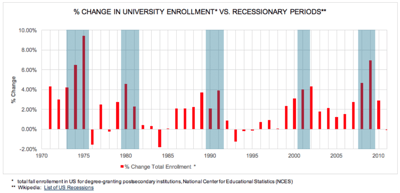

The Facts About Recession-Resistant Real Estate

All commercial real estate is cyclical. Historically, some property types have values that tend to correlate with overall economic conditions more so than others. Retail and office properties for example have been known to take a hit during economic downturns. During the Great Recession and its aftermath, apartments became a hot investment ticket, while single-family housing values plummeted.