The Realized Team’s Picks

Collectibles as an Alternative Asset: What You Need to Know

Collectibles can take many forms and whether a particular collectible will grow in value is a gamble. Remember the Beanie Baby investors? But collectibles often have a benefit that is unique compared to other investments. When looking to diversify a portfolio, could collectibles be a part of your investment strategy?

How to Get Power of Attorney

Designating a power of attorney (POA) for your accounts serves several purposes. A POA can act on your behalf during a real estate investment transaction or make decisions regarding personal financial assets or medical care if you become incapacitated.

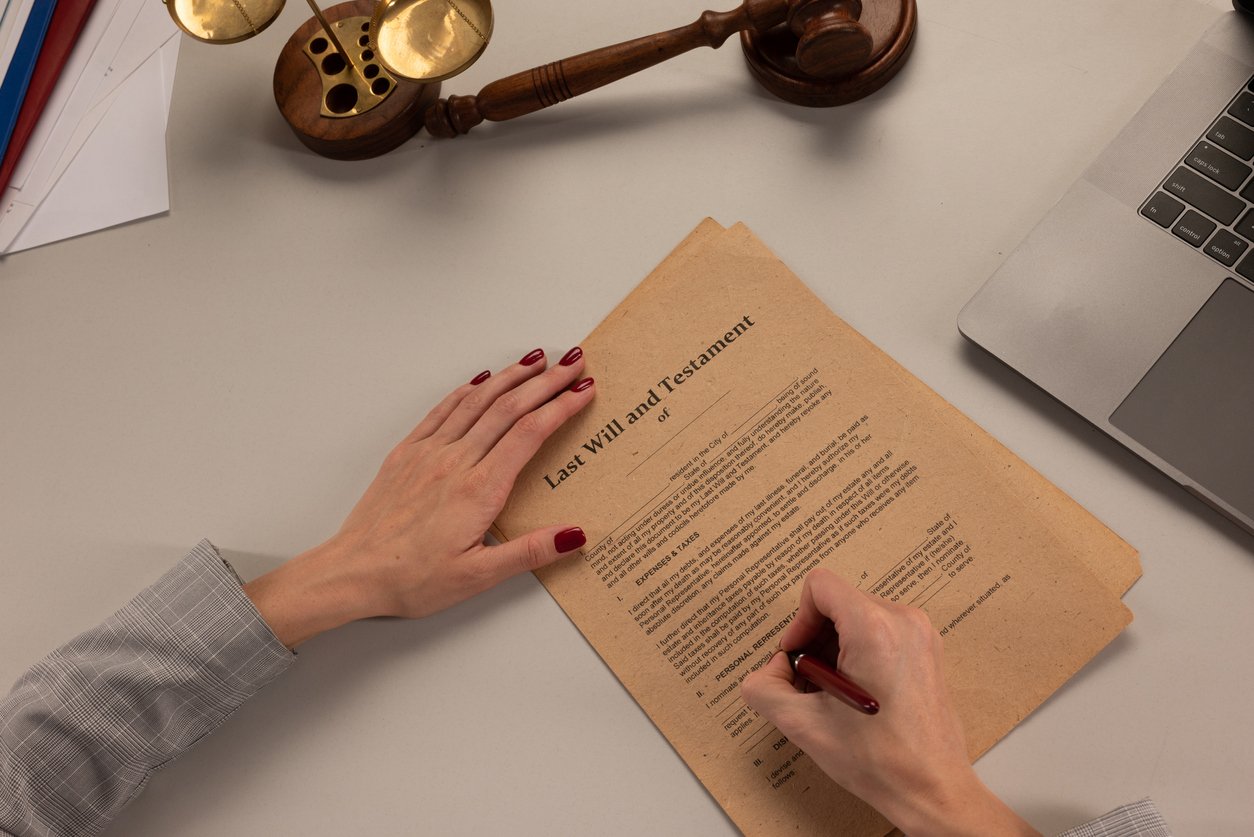

Can an Executor of a Will Be a Beneficiary?

When an individual creates their last will and testament, they designate someone to execute their instructions. That person, referred to as the will’s executor, is tasked with ensuring that the will's provisions are followed. If a will lacks a designated executor, the probate court will name one for the job. The executor must act in the best interests of the estate as a whole, even if that is counter to the wishes of one or more beneficiaries. If the beneficiaries don’t want the instructions in the will carried out, the executor is obligated to follow the instructions of the deceased, not the beneficiary. It’s important to note that an executor cannot change or delete beneficiary designations.

Can You Depreciate Inherited Property?

Investors can take advantage of tax deductions by using depreciation on their investment properties. Depreciation is available for residential and commercial real estate owners who use their properties for business or income-producing means.

How Do REITs Perform in a Bear Market?

When investors discuss the stock market, they may use terms like “trading,” “bear market,” “bull market,” “correction,” “volatility,” and more. So if you participate in the market, aspire to, or just want to keep up with current economic conditions, it’s a good idea to develop your knowledge of how the market works.

How Do Rising Interest Rates Affect REITs?

Real Estate Investment Trusts continue to show sustained popularity with investors seeking income and returns. In fact, the Wall Street Journal reports that the funds managed more than $224 billion by the end of 2021. Among the motivations for shareholders are the desire to own commercial real estate, the pursuit of truly passive income, and returns that have often outpaced increases in the cost of living. Some investors who have held real estate and managed it actively prefer to transition to REIT participation as a way to maintain their real estate involvement without the need to remain involved with tenants directly.

Can a Minor Be a Beneficiary?

We’ve written extensively about beneficiaries in previous blogs, and for very good reason. Wealth building through investments is only part of the issue. The other part is your passing. Specifically, naming a beneficiary helps ensure your wealth is successfully transferred without legal wrangling over your estate.

What Qualifies as an Investment Property for a 1031 Exchange?

A 1031 exchange is a method that taxpayers can use to defer the payment of capital gains when they sell real estate under certain circumstances. For the transaction to succeed, it must involve the exchange of one investment property for another, and the properties must meet the IRS' definition of "like-kind." In addition, there are some other crucial rules governing the process, all of which the taxpayer must follow to avoid disqualification of the deferral:

What Is Next of Kin and How Does it Work?

If you die without leaving a will, you leave behind a complicated financial situation for your potential heirs. Regardless of any wishes you had for your estate while you were alive, your financial assets will be distributed according to the laws of your state.