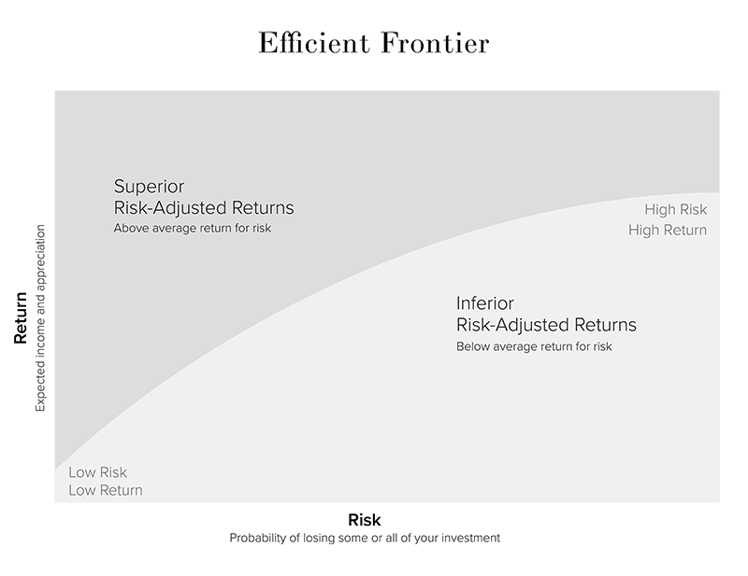

In 1952, Nobel Laureate Harry Markowitz created the efficient frontier. It represents a set of optimal portfolios with the highest expected return for a given level of risk. These optimal portfolios are also well-diversified.

The goal of modern portfolio theory is to create an investment portfolio that exists on the "efficient frontier." The efficient frontier exists on the coordinate plane, which is a two-dimensional plane with a vertical and horizontal axis.

The vertical axis represents the expected return of a portfolio, while the horizontal axis represents the perceived risk of a portfolio. Any portfolio that falls below the efficient frontier is sub-optimal, as it provides less expected return for the same amount of perceived risk, or more exposure to perceived risk for the same expected return. A portfolio that exists on the efficient frontier strives to produce the highest expected return for any given level of perceived risk.