A valuation method used to estimate the feasibility and attractiveness of an investment opportunity. DCF analysis utilizes future free cash flow (FCF) and discount rate estimates to determine a net present value (NPV) of the investment. If the present value of the cash flows is higher than the initial cost of the investment, the DCF analysis will show a favorable investment, or positive net present value (NPV). If the initial cost is higher, however, the NPV will be negative, showing an unfavorable investment.

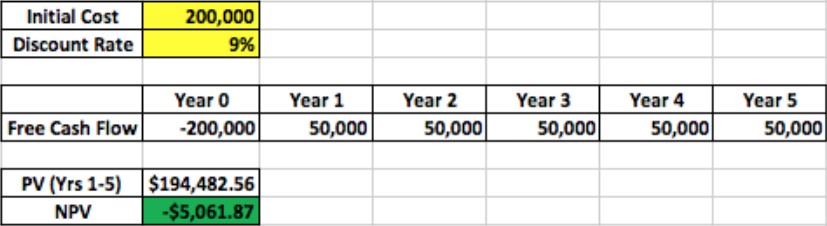

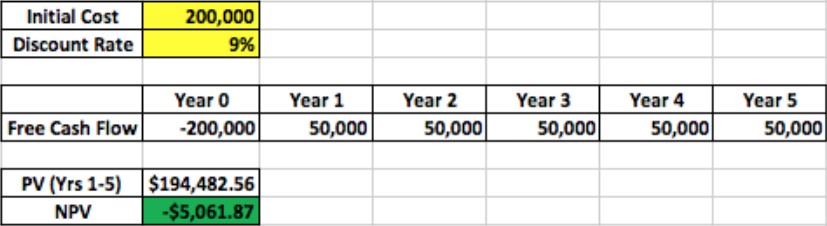

For example, an investor has estimated that a project they are investing in will generate a FCF of $50,000 over the next 5 years with a cost of capital of 9%. Taking into account the time value of money, the investor determines that the present value of the investment is approximately $195,000. If the initial cost of the project is $200,000, the NPV would be about -$5,000, showing a poor investment opportunity.