Page 14 131 - 140 of 144

What States Don't Conform With QOZ Tax Benefits?

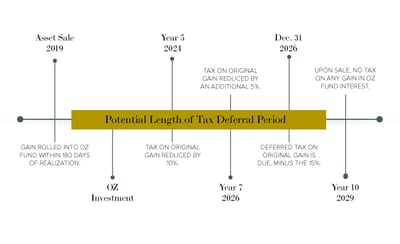

One of the highlights of the 2017 Federal Tax Cuts and Jobs Act (TCJA) is the Qualified Opportunity Zone (QOZ) program that gives taxpayers the ability to defer and potentially eliminate certain capital gains. Effective starting in 2018, the program is available for a limited window of time, and only provides incentives throughout a ten-year tax deferral period. To continue learning about the program, take a look at the timeline below, or read more here.

Tax Benefits Of Opportunity Zones

In December 2017, the Tax Cuts and Jobs Act was passed, offering a brand-new tax incentive for investors called Qualified Opportunity Zones (QOZs). Through the Qualified Opportunity Zones program, the federal government certified distressed, low-income communities throughout the United States as Qualified Opportunity Zones, providing much-needed resources to communities in need while offering tax advantages to those who invest in these neighborhoods.

The 90% Test Explained

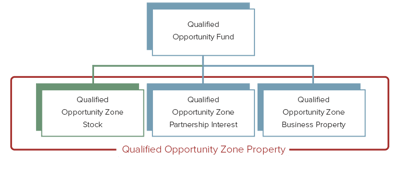

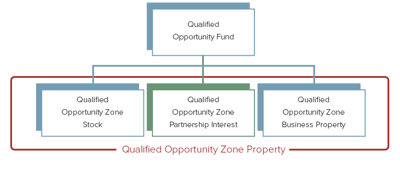

The 90% Test is a method to validate if a QOF (Qualified Opportunity Fund) qualifies for the benefits of a QOZ (Qualified Opportunity Zone). The QOF must hold 90% of its assets in a QOZP (Qualified Opportunity Zone Property). A QOZP can be any of the following property types: QOZ business property (QOZBP). QOZ stock. QOZ partnership interests.

Qualified Opportunity Funds: Deferral And Potential Forgiveness Of Capital Gains

In December 2017, a U.S. congressional bipartisan effort known as the Opportunity Zone Program was added into the tax reform legislation (Tax Cuts and Jobs Act of 2017). The intent of the program is to encourage individual investors and companies to invest in specific census tracts around the US in an effort to promote economic development in low income communities.

The Concept Of “Property” Among Qualified Opportunity Funds

Investing in a Qualified Opportunity Zone (QOZ) program is fairly straightforward. An investor takes their realized gain from an asset sale and invests it in a Qualified Opportunity Fund (“QOF”) to defer taxes on that gain. At the same time, the investor will potentially avoid capital gains on the appreciation of the Qualified Opportunity Zone Property. Another bonus is the QOF will put their funds to work in a low-income community that might be in dire need of resources. In business parlance, this represents a “win-win-win.”

Qualified Opportunity Zone Stock: Buying Pieces Of A Company

Qualified Opportunity Zone Stock, or QOZ, is one of the three designated asset types collectively called Qualified Opportunity Zone Property, in which a Qualified Opportunity Fund (“QOF”) can invest.

Deadline Approaching To Defer Capital Gains By Investing In Opportunity Zone Fund

For investors who reported significant capital gains on their 2018 K-1s or had capital gains from business and investment partnerships, there’s a way to potentially receive favorable tax advantages — both short- and long-term — on those profits. However, the deadline to defer payment of certain 2018 gains until 2026 — as well as the potential to reduce total tax liability on said gains by 15 percent if held for 7 years — is June 28.

Properly Defining Qualified Opportunity Zone: Business Property

People and businesses invest money in different property types for all sorts of reasons. From a legal standpoint, property is defined as something you own. Qualified Opportunity Funds (“QOF”) are uniquely positioned to invest in Qualified Opportunity Zone (“QOZ”) Business Property in a way that may change strategies for investors across the U.S.

(Almost) Everything You Need To Know About Qualified Opportunity Zone Investments

Excitement about, and interest in, the new Qualified Opportunity Zone Program (OZP) is growing among investors, developers and sponsors. This program promises some exciting benefits, such as:

Qualified Opportunity Zone: Partnership Interest

The term partner or partnership is one of the most overused terms in the business world today. It takes on a variety of definitions depending upon context. However, the concept of partnerships, or rather, partnership interests, are more well defined when it comes to the Qualified Opportunity Zones (“QOZ”) Program.

Page 14 131 - 140 of 144