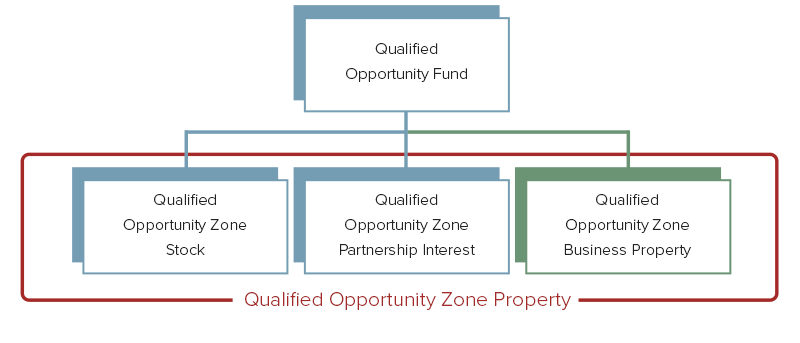

People and businesses invest money in different property types for all sorts of reasons. From a legal standpoint, property is defined as something you own. Qualified Opportunity Funds (“QOF”) are uniquely positioned to invest in Qualified Opportunity Zone (“QOZ”) Business Property in a way that may change strategies for investors across the U.S.

Moving the definition of “property” into the Opportunity Zones program, QOZ Business Property is considered tangible property in a QOZ that is used in a trade or business.

In this article we will specially dissect Opportunity Zone Business Property (“QOZBP”), which is considered tangible property in a QOZ used for trade or business. (Learn more about the other two asset types: stock and partnership interests.)

The definition of a QOZBP refers to real property, or real estate, and can also include equipment and other tools used to run a business in the targeted zone. There are three components a business property must have in order to be considered a designated QOZBP including:

- The fund must have purchased the target property after Dec. 31, 2017. In other words, if your fund acquired a QOZ building on Dec. 15, 2017, it would not be eligible as a QOZBP.

- The property’s original use in the Opportunity Zone begins at the same time as the Qualified Opportunity Zone Business. For example, the above-mentioned building is a fully operational hotel your fund buys on Jan. 1, 2018. Assuming the Qualified Opportunity Fund does not plan on “substantially improving” this hotel over an ensuing 30 month period, this property would not be classified as QOZBP.

- The property is substantially improved through the fund. The above situation would be different if your fund acquires an abandoned, shuttered hotel on Jan. 1, then substantially improves it. “Substantially improved” means if, during any 30-month period following the date of the property’s acquisition, additions to the property’s basis (through the fund) are greater than the adjusted basis of the property at the beginning of the 30-month period. “Basis” is another name for “cost.”

To illustrate, say your QOF acquired the vacant hotel for $10 million, with the intent of turning it into workforce housing. The property’s basis is $10 million – what your fund paid for it. During its first year of ownership, the fund invests an additional $10 million (plus $1) into property upgrades pushing the basis to $20 million+. The fund’s formerly empty hotel is now substantially improved, based on the QOZBP definition.