Investing in a Qualified Opportunity Zone (QOZ) program is fairly straightforward. An investor takes their realized gain from an asset sale and invests it in a Qualified Opportunity Fund (“QOF”) to defer taxes on that gain. At the same time, the investor will potentially avoid capital gains on the appreciation of the Qualified Opportunity Zone Property. Another bonus is the QOF will put their funds to work in a low-income community that might be in dire need of resources. In business parlance, this represents a “win-win-win.”

How exactly do these QOFs work? As is the case with other federally sponsored programs, several rules exist when it comes to QOFs. One is that the fund in question is required to invest in a Qualified Opportunity Zone Property (QOZP).

Defining “Property” for QOFs

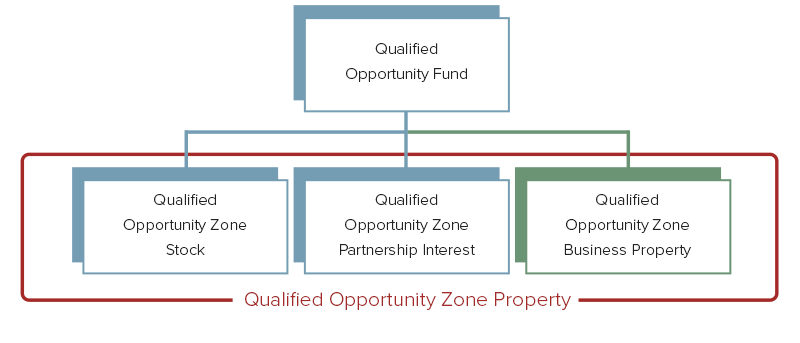

The definition of a QOZ Property can take different forms, as shown in the graphic below. The fund can invest in stock, partnership interest or tangible business property situated within a QOZ. An investor can defer any amount of capital gains from the sale of any investment as long as the requirements listed below are met:

- The reinvestment takes place within 180 days of the sale

- The invested amount is only the realized gain. For example, if an individual sells $2,000,000 in stock that results in a $700,000 capital gain, and the taxpayer invested the entire $2 million of proceeds in an Opportunity Fund, the investment would be treated as two investments of $700,000 and $1,300,000, with only the first investment ($700,000) eligible for the program.

- All of the gain goes into a QOZ, by way of a QOF investment

The graphic below shows a breakdown of property in which a Qualified Opportunity Fund might invest:

Ensuring QOF Compliance

As soon as the U.S. Treasury Department and Internal Revenue Service issue QOF guidelines, many QOF's will formulate. As such, investors need to keep an eye on certain components to make sure they are in compliance and are investing in legitimate organized funds including the following:

- Invest gains as equity into a QOF. Loans are not eligible for tax-deferral incentives.

- At least 90% of the fund’s property are situated, and must operate, within Qualified Opportunity Zones. If 80% of a target fund’s assets are invested in a Qualified Opportunity Zone Property, it is below the threshold and could incur a penalty for falling short.

- The fund can invest only in Qualified Opportunity Zone Property (per diagram above), and NOT another Qualified Opportunity Fund.

- That QOF stays away from so-called “sin” businesses such as golf courses, country clubs, massage parlors, hot tub or suntan facilities, racetracks or other gambling facilities.

- The QOF also needs to refrain from selling alcoholic beverages for off-premise consumption. For example, If the business a restaurant that sells wine, it would qualify. If the business is a liquor store selling bottles of vodka and scotch, it would not.