We hear it all the time, real estate is an illiquid asset. Commonly used in the context of risk, Investopedia defines illiquidity as “the state of a security or other asset that cannot easily be sold or exchanged for cash without a substantial loss in value.”1 Opposite to securities that are traded at high volumes, such as stocks and treasury bonds, illiquid assets include private securities and hard assets that are not traded as frequently.

So what determines whether an asset is liquid or illiquid, and what are potential consequences of owning an illiquid asset? Keeping real estate in mind, this article looks to explain the science behind why real estate is considered illiquid, as well as the benefits and risks that are commonly associated with these types of assets.

Real Estate as an Illiquid Asset

So what are the characteristics of an illiquid asset, and why is real estate considered one? Although most illiquid assets share a degree of similarity in being hard, tangible assets, this is not the main contributing reason as to why they are considered illiquid. Illiquidity stems from the depth of supply and demand within an asset’s market, as well as the nature of the asset, such as ease of valuation and ability to transact.

In 2018, real estate development and operation contributed $1.0 trillion to the U.S. GDP, which is up from $935.1 billion in 2017.2,3 Although this may hint at a market with a healthy level of supply and demand, you must look to the nature of the market and the asset to understand why real estate is considered illiquid:

- Lack of Public Markets: Contrary to most securities, most real estate transactions are done in private markets. Whereas public markets offer daily pricing and extensive consumer knowledge, private markets are priced on a “as-needed” basis and lack transparency. Private markets are harder to access as well, as many private markets require a degree of credibility or status to enter into.

- Difficulty of Transacting: As you may be aware, real estate closings require several interested parties, and a lot of paperwork. Between structuring an offering, arranging financing, and gathering necessary due diligence items, the process could take weeks, only contributing to lack of ability to turn real estate into cash quickly.

- Access to Capital: There is no question that real estate can be expensive. When transactions require significant pooling of capital, in the form of both equity and debt, transactions move slower. During the operational phase, while equity owners may have difficulty finding a buyer for their respective interest, lenders may put covenants on how the property is managed financially.

Although these factors highlight why real estate is considered illiquid, they do not tell the whole story. Transaction costs, demand pressure and inventory risk, and inability to find buyers and sellers all add to the illiquid nature of real estate.

DSTs and Illiquidity

Unfortunately for fractional 1031 investors, DSTs are subject to the same forces that cause other real estate investments to be illiquid. One could even argue that a DST investment may be more illiquid than direct property, as investors lack control on when to sell. Realized, however, has established DST resales where investors can get help finding a buyer for their seasoned investments that they are looking to exit. Although there is no guarantee of a sale, investors can obtain an opinion of value and have the opportunity to receive an offer for their DST interest.

Is Illiquidity All Bad?

Although illiquidity may have a negative connotation in the investing world, it may not be a bad strategy to introduce in an investment portfolio. Here’s why:

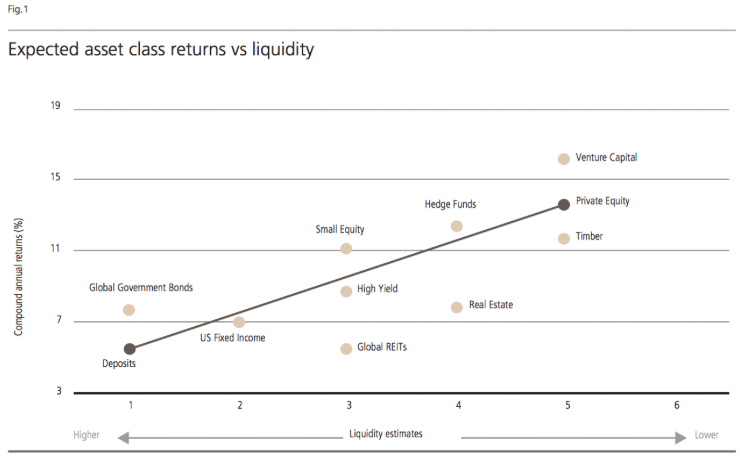

- Illiquidity Premium: As a starting point, illiquid assets can offer a premium to liquid assets. This premium is more than just a higher required return on your investment, however, and derives itself from how illiquid assets are managed. Illiquid markets typically rely on fund manager skill and expertise, only increasing the chances of taking advantage of favorable opportunities.4 As seen by Figure 1 below, illiquid assets have historically produced higher returns than more liquid ones.

- Limited Price Volatility: Related to the ‘Downturn Protection’ and ‘Lack of Public Markets’ sections above, private markets such as real estate, are insulated from price volatility. While the stock market has seen historical volatility due to COVID-19 and the economic shutdowns, real estate values have been stable. In the stock market, market value is straight forward — the price the stock is trading at. Marking real assets to market value is imprecise and difficult due to the relative infrequency of transactions. From an overall portfolio perspective, the allocation to real estate, at the least, should help manage volatility. Looked at another way, an allocation to real estate instead of stocks is designed to reduce portfolio volatility.

Source: “Expected Returns”, by Antti Ilmanen, 2011. Scatterplotting average asset returns 1990-2009 on (subjective) illiquidity estimates. Sources: Bloomberg, MSCI Barra, Ken French’s website, Citigroup, Barclays Capital, J.P Morgan, Bank of America Merrill Lynch, S&P GSCI, MIT-CRE, FTSE, Global Property Research, UBS, NCREIF, Hedge Fund Research, Cambridge Associates. For illustrative purposes only. Actual future results may differ materially from expectations.

- Downturn Protection: As discussed by NAREIT, private real estate valuations respond more slowly than public valuations. In fact, illiquid pricing lags behind the public market by two to five quarters on average, depending on whether the private valuations are being conducted based on comparable transactions or appraisals.5 Although property values may even-out in the long run, relying on the same market conditions such as employment growth and supply and demand, illiquid assets may help balance a portfolio during an economic downturn.5

- Diversification: Lastly, illiquid assets could offer diversification from more liquid, publicly traded assets such as public equities. Allocating capital across various asset classes may help balance a portfolio, to insure that your money isn’t tied up in one particular market or asset.6

- https://www.investopedia.com/terms/i/illiquid.asp

- https://www.naiop.org/en/Research/Our-Research/Reports/Economic-Impacts-of-Commercial-Real-Estate-2018

- https://www.naiop.org/en/Research/Our-Research/Reports/Economic-Impacts-of-Commercial-Real-Estate-2019

- UBS. The value of illiquidity: the case for alternative investments.

- https://www.reit.com/news/blog/market-commentary/comparing-real-estate-values-liquid-and-illiquid-markets

- Diversification does not guarantee returns and does protect against losses