The Realized

Secondary Market

Get Help Selling DST Interests

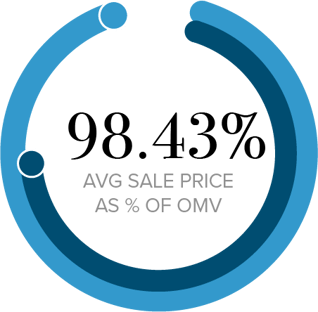

Investors who wish to sell their DST interests face limited options due to their illiquid nature. However, working with Realized provides investors with a few options that may help1.