Paying a contractor requires filing Form 1099. But what happens if that contractor is a foreign entity? In that case, you’ll want to start considering Form 1042, which is used for U.S. sourced income payments to foreigners. As usual, it is best to work with your accountant to determine if the form fits your scenario.

What Is Form 1042?

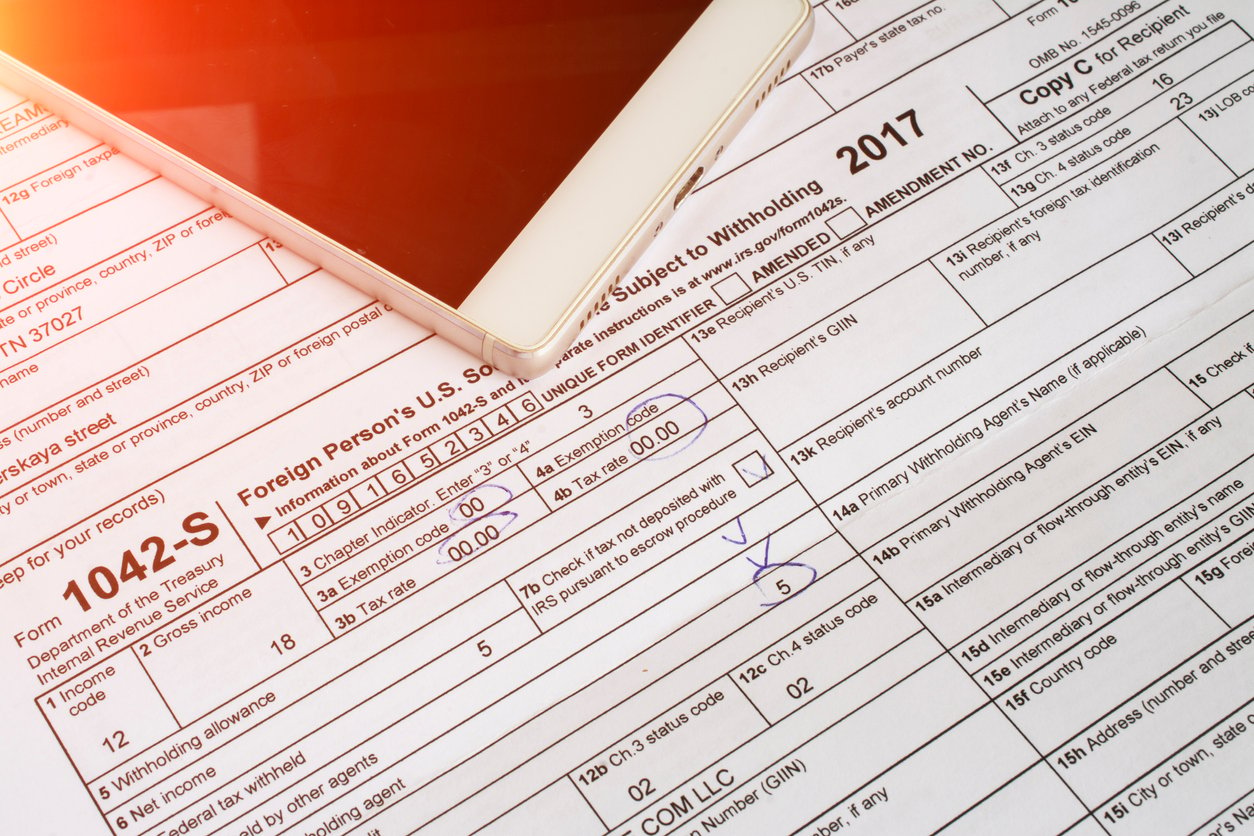

Form 1042 and 1042-S are two different forms but related to the filing of income payments to foreign entities. They are often filed together.

- Form 1042 — Annual Withholding Tax Return for U.S. Source Income of Foreign Persons

- Form 1042-S — Foreign Person's U.S. Source Income Subject to Withholding

Form 1042-S is for individual income payments to foreign entities while Form 1042 is the aggregate of those payments during the year.

For entities that provide income to a foreign entity, Form 1042-S may be required when filing your taxes. Form 1042-S is a tax withholding form. It identifies the two parties involved and the amount that will be withheld.

If you are making payments to a foreign (non-resident) entity or person of U.S. source income, Form 1042-S is required. The form shows how much income is paid to the non-resident and how much tax is being withheld.

What Is On Form 1042?

By comparison, Forms 1042 and 1042-S are more complicated than Form 1099. Meaning they are larger and require more reporting.

Form 1042 consists of five sections:

- Intro — name of withholding agent and pertinent status codes

- Section 1 — Record of Federal Tax Liability. This section shows the tax liabilities incurred throughout the year from withholdings along with the total tax liability.

- Section 2 — Reconciliation of Payments of U.S. Source FDAP Income. FDAP income is Fixed, Determinable, Annual, or Periodical income. This section is for reporting the total amount of income paid throughout the year.

- Section 3 — Potential Section 871(m) Transactions. Used if Section 871(m) transactions may apply.

- Section 4 — Dividend Equivalent Payments by a Qualified Derivatives Dealer (QDD).

Sections 3 and 4 are one checkbox each.

When Is It Used?

Form 1042 and 1042-S are required under the Foreign Account Tax Compliance Act (FATCA).

To better understand when Form 1042-S is used, let’s go through a couple of examples.

Example 1 — A foreign entity has a savings account in the U.S. that has earned interest. The earned interest is U.S. sourced income. In this particular case, the interest income is considered portfolio interest. Therefore, it is exempt under the portfolio interest exemption (Chapter 3 of Publication 519) and there is no withholding tax. While this income is not taxable, it must still be reported on 1042-S.

Example 2 — A U.S. company (C-corp) is owned by a UK company. The U.S. company issues a $50,000 dividend distribution to the UK company shareholder. Due to Treaty Benefits, the UK company claims a reduced withholding of 15% on U.S. source dividends vs. the standard 30%. The U.S. company withholds $7,500 in taxes and pays it to the IRS.

At the end of the year or beginning of the next year, the withholding agent completes Form 1042 for all of the 1042-S forms that were completed.

IRS Withholding Tool

The IRS has a new online withholding tool to help withholding agents verify the quality of their data. The tool is not meant to be a substitute for filing 1042-S. Agents must still file Form 1042-S even if they use the online tool.

This material is for general information and educational purposes only. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. Realized does not provide tax or legal advice. This material is not a substitute for seeking the advice of a qualified professional for your individual situation. Examples shown are hypothetical and for illustrative purposes only.