As we approach the July 15, 2020, Internal Revenue Services filing deadline amidst the global pandemic, our team at Realized wanted to share some thoughts and statistics that we are seeing in the market. Our goal with this data is to help Qualified Intermediaries (QIs) and their clients better navigate the next three weeks leading up to the deadline.

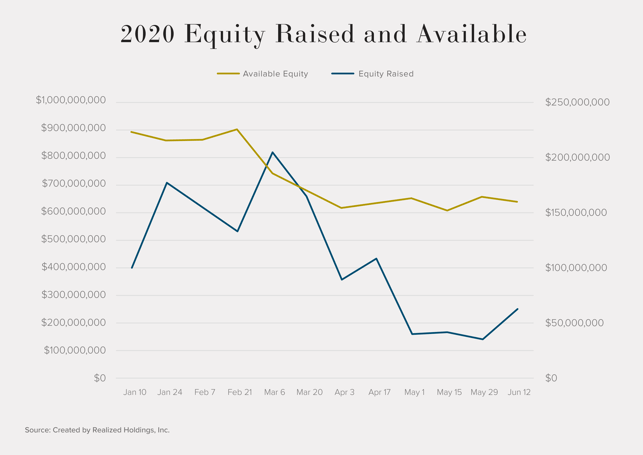

In the first section, we and others in the industry have quantified what we think is about three times the demand that we would normally see in the marketplace. Secondly, we took a look at supply. We estimate that this supply across the board is muted by about 20%. Lastly, you’ll see an overview of Delaware Statutory Trusts (DSTs) and how they can be used in these trying times to offset the property shortage and help your client have a successful 1031 exchange.

At the bottom, we have included our contact information. If you have any questions, or are seeking guidance during these unprecedented and unpredictable market times, please reach out to our team. We are ready and available to assist you in any way that you need.

High Demand in the 1031 Market

When the IRS announced various deadline extensions in April 2020, a large bulk of the U.S. population breathed a collective sigh of relief. The extension of quarterly tax payments and filing deadlines from April 15 to mid-July provided wiggle room for taxpayers dealing with COVID-19’s economic fallout.

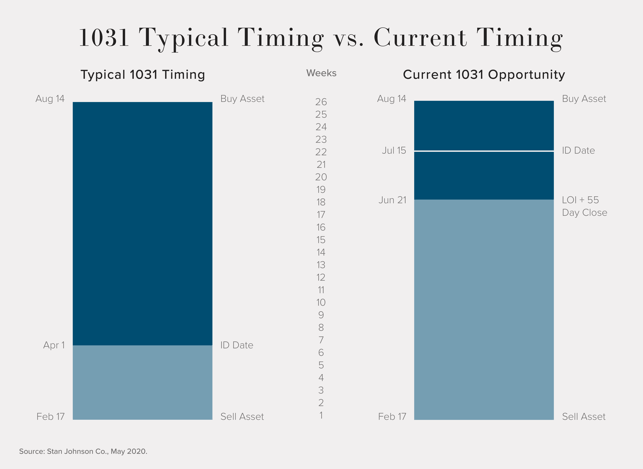

However, for these 1031 investors, their 45-day countdown to identify replacement property/properties began on May 31. The coronavirus pandemic has thrown the economy and real estate market into turmoil, leading to serious issues for exchange buyers, which means they are not the only investors trying to find a replacement property. They are competing against others, who have that same July 15 deadline.

Supply is 12-20% Lower Nationwide

According to the First American Potential Home Sales Model for the month of April 2020, “The market potential for existing-home sales decreased 12.6 percent compared with a year ago, a loss of nearly 672,230 seasonally adjusted annual rate (SAAR) sales.” Some markets, like Central Texas, are down as much as 20%.

Sellers are removing their properties from the market, at least until the economy stabilizes. This has led to a dwindling supply. In one scenario, investors attempting to exchange into rental homes and duplexes have found available supply decreased by 20%. Similar numbers are reported among net-lease properties and other commercial real estate.

Even if investors can find a viable replacement property, the spread between what they are willing to pay and what the seller is willing to accept might be far apart. The seller will probably want a pre-pandemic price, whereas buyers might be basing their bid on current economic uncertainties, such as double-digit unemployment and tenant uncertainty. If the bid is too low, and the seller doesn’t like it, he or she can move on to another buyer who might be more amenable. And, as mentioned above, there are plenty of buyers looking for properties.

This supply shortage impacts more than just the investors interested in direct ownership of potentially revenue-producing single-family or similar properties. Passive real estate investment vehicles, such as Delaware Statutory Trusts (DSTs), are also likely to feel the supply pinch. DSTs allow investors partial ownership of portfolios containing institutional-grade commercial real estate assets. However, such real estate is also anticipated to be in short supply, meaning potential challenges.

11 Uses for a DST in your 1031 Exchange

A Delaware Statutory Trust, or DST, is a legal entity constructed under Delaware law, which enables fractional property real estate investments. These fractional investments can be made in large institutional-grade properties and are an attractive option for many 1031 exchange investors. A DST can make the process of investing and meeting exchange requirement timelines relatively simple for investors. Learn how they simplify the 1031 exchange process below.

1. Move from Property Ownership to Managing Real Estate Wealth. Considered by some to be an upgrade in portfolio quality, a Realized DST portfolio is built to your own risk appetite and property preferences. These portfolios are professionally managed and diversified across property type, sponsor, location, and tenant in an attempt to be more stable and a lower risk investment than a single property.

2. No Minimums. Investors can exchange as little capital as they want into a DST — whether that be the full principal, or the remaining assets leftover from a property exchange.

3. Financing in Place. With a 1031 exchange, the debt on the replacement property must be greater or equal to the debt from the relinquished property, which can sometimes be challenging. In a DST, each investor is a “beneficiary” with an ownership interest in the Trust, which in turn owns the property. The IRS treats these as direct property ownership, thus qualifying for a 1031 exchange. When a DST owns a replacement property, the DST is the borrower and investors will not need to be individually qualified with a lender nor responsible personally for the debt.

4. Establish a Back-up Plan. A common strategy to identify replacement properties is the “200% Rule,” where an exchanger may identify up to 200% (and 3 properties) of the fair market value, within 45 days. This can provide additional options over just one property in case it falls out of escrow for financing, inspections, etc. Identify the first-choice property and then identify two additional properties owned by DSTs. It costs no extra money to identify additional properties and helps to ensure no taxes are ever paid.

5. Institutional Quality Properties and Debt Options. Realized works with 251 of the most established Commercial Real Estate sponsors in the U.S., each of which offers a wide variety of property types, debt options, locations, and tenants. This broad industry coverage allows investors to build diversified, risk-managed portfolios of high-quality, institutional-grade properties built on a client’s risk and preferences.

1As of January 2020

6. Estate Planning and Exit Strategies. Investing in a DST offers easily divisible options for the estate heirs. The heirs continue to receive distributions from the investment or sell via Realized’s secondary market. In the event of a transfer of ownership, DSTs can also be easily divided up, allowing everyone to choose a solution that is best for their needs. One heir can continue to exchange the investment, while another can sell and receive cash proceeds.

7. Eliminate Taxable Gains on Boot. Matching the exact dollar amount of a replacement property can be challenging in 1031 transactions. For example, the relinquished property sells for $1 million, and the exchanger identifies a replacement property for $800k. The difference in the property values results in a taxable amount on the remaining $200,000. Because of the “3 Property Rule,” DSTs provide a solution to eliminate the taxes.

8. Reduce the Landlord Burden and Leverage Tax Strategies. DSTs are professionally managed by a third party. Professional managers not only eliminate the need for landlord duties, they also are experts about the operations of a property. These expenses, along with leveraging useful tax strategies such as interest and depreciation expenses, can also further shelter the taxable income on the distributions.

9. The Ultimate in Real Estate Diversification and Managing Risk. Investing in a portfolio of DSTs can provide portfolio diversification over a single property. Realized Portfolios™️ are built from multiple DSTs and represent multiple properties spread across sponsor, tenant, property type, industry, and location. This is designed to provide a portfolio with a level of risk management, which we believe makes for a stronger Investment Property Wealth Management™️ strategy overall.

10. More Opportunities to Sell. The burden of finding a new property for some investors is the largest barrier to selling the property they currently own. Having the option to build a diversified portfolio of institutional-grade properties via DSTs may be just the solution for an investor to sell an aging or poorly performing property and upgrade their real estate portfolio.

11. Future 1031 Exchange Eligible. The DST structure allows the investor to continue to 1031 exchange properties as many times as they choose. Upon the death of the investor, under current tax laws, the heirs would get a “step-up” in basis, thereby avoiding capital gains taxes on the original and subsequent properties.

In Summary...

When supply is low and demand is high, DSTs can be a solution for 1031 exchangers who are having trouble identifying a property. Let us equip you to guide your investors through a successful exchange — even in an unbalanced market. Contact us today. The Team at Realized is ready to support your business.